Good day, small business champions! Today, we’re talking about internal control systems and audit. Think of it as your business superhero cape against financial mishaps. Let’s further dive into how you can protect your hard-earned success with some smart tips and tricks.

- The Importance of Internal Controls

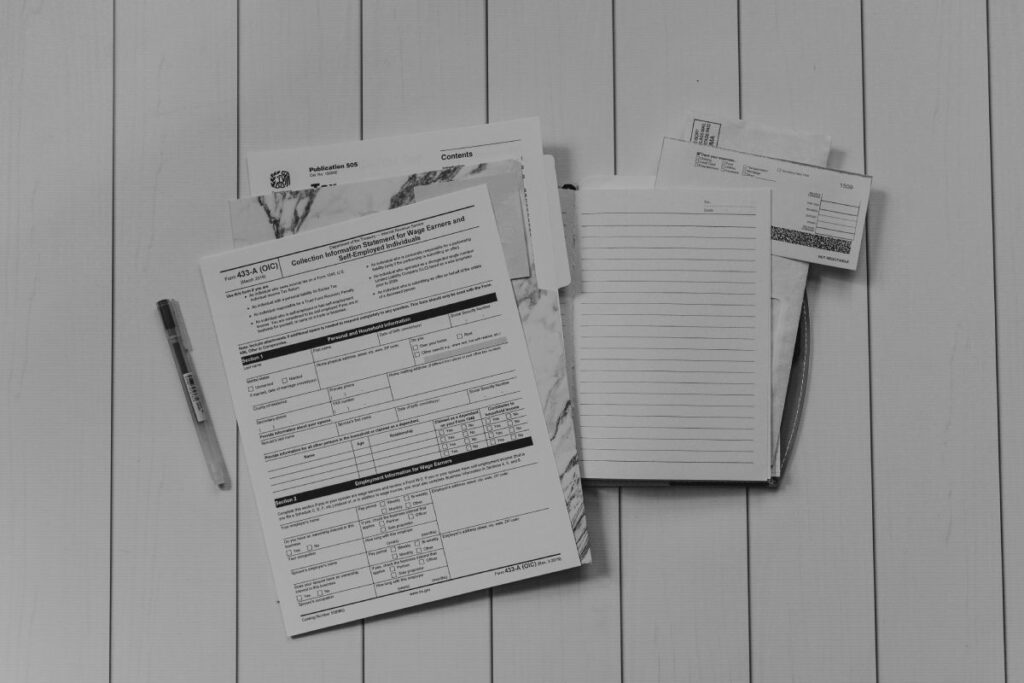

So what exactly are internal controls, and why are they important? They are essentially your business’s checks and balances—systems and procedures that are put in place in order to protect its assets, ensure correctness in the financial reporting, and prevent possible fraud. From performing daily reconciliations to segregating cash-duties, these types of controls certainly help your business run smoothly.

- Implementing Effective Control Procedures

But put things in perspective: the implementation of control procedures is initiated by assessing the risks in your business. That is, it must define which areas are vulnerable because of mistakes or misuse—cash handling or inventory management, for example. Make explicit the policies and procedures that lay down the methods by which tasks have to be performed or executed and who is responsible for what. These procedures should be reviewed periodically and modified according to the changes brought out by business growth and change.

- Internal Audits at Regular Intervals

Ah, the dreaded audit—cue dramatic music. But fear not, internal audits are here to be your friend! They are quite similar to a health check for your internal controls that may help pick up and nip in the bud some weaknesses before they become major issues. Schedule regular audits of your procedures to check that they are being followed. Use the findings to improve and tighten up your controls where necessary. Think of it as proactive maintenance for your business’s financial health.

Conclusion

Safeguard your small business with internal controls and audits. Compliance is not only the safeguard for reputation but also conducive for sustainability. Implement effective processes and do regular audits in order to realize internal controls and build an assurance for growth. Remember, it’s not one size fits all; adapt it to the need of your unique business. So embrace the power of internal controls, always be on the lookout, and watch your business grow—safely and confidently. You’ve got this, small business superhero!